Local News

Calgary hailstorm costs soar past $160M

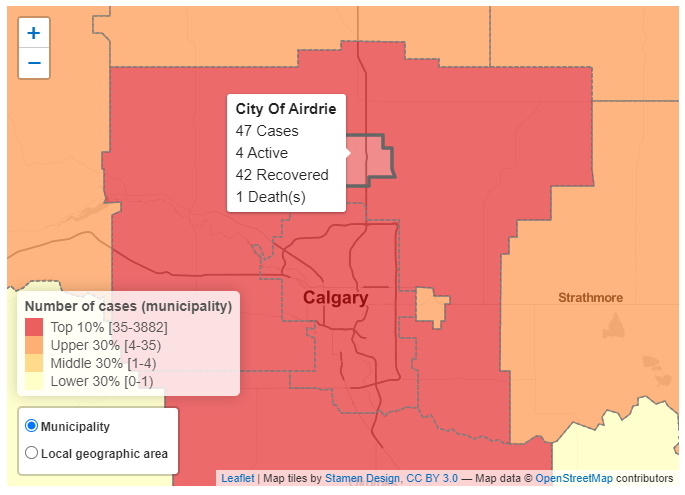

Insured damage from a hailstorm that struck Calgary on July 13 has nearly doubled initial estimates to $164 million, the Insurance Bureau of Canada says. New figures from Catastrophe Indices and Quantification Inc. (CatIQ) show losses up 78 per cent from the original $92 million estimate, with commercial losses increasing significantly. Damage to vehicles represented more than half of all claims. Related Stories: Another insurer pulling out: what Airdrie drivers need to know about CUMIS’s exit Calgary sits within “Hail Alley,” a region long known for frequent and damaging storms. “It’s been another catastrophic year for hailstorms in Alberta,” Aaron Sutherland, IBC’s vice-president for the Pacific and Western regions, said Friday. “The July 13 Calgary hailstorm storm caused significant damage to vehicles, homes and businesses. Alberta has now experienced at least one major hailstorm every year for the past two decades – including last year’s record $3.2 billion hailstorm that hit Calgary. This has resulted in more than $10 billion in insured damage. The past five years alone damage from hailstorms has accounted for $6 billion of that total.” CatIQ last month released a one-year update on the Aug. 5, 2024, Calgary hailstorm that caused more than $3.2 billion in insured losses. That storm was the costliest hailstorm — and second-costliest natural disaster — in Canadian history. Another major hailstorm hit Brooks, Alta., on Aug. 20. IBC says an initial estimate for that event will be released in the coming weeks. Sutherland said claims from both storms will take time to resolve, but insurers “will support their customers every step of the way.” “There will be a high demand for contractors to fix siding and roofs, and a high demand for replacement vehicles and auto body repairs,” he said. “This will add additional costs pressures on Alberta’s challenging insurance market, but rest assured our industry will be there to help Albertans recover as quickly as possible.” IBC is urging governments to revive Calgary’s Resilient Roofing Rebate Program, mandate hail-resistant materials in high-risk areas, and improve hail notification services. It has also called for national measures such as halting development in high-risk flood and wildfire zones, investing in FireSmarting, subsidizing home retrofits, and creating a federal disaster-management agency. A large share of the July storm’s claims were for vehicles, which Sutherland said underscores the pressure severe weather is placing on Alberta’s auto insurance system. He said insurers paid out $1.20 in claims and expenses for every $1 in premiums in 2024. “As severe weather and other pressures on the insurance system climb, the cost of providing auto insurance continues to grow. Yet for the past three years, the Alberta government has frozen or capped auto insurance premiums below the cost of providing coverage – the longest period of government interference in auto insurance in Canadian history,” IBC said. “Consumers are feeling the impact of an auto insurance system [in] crisis,” Sutherland said. “The cost of insurance is reflecting increased claims pressure even under the rate cap, and some consumers are having challenges securing coverage. The government must remove the rate cap and ensure the Care-First reforms are implemented effectively – especially by reining in out of control legal costs. IBC continues to work with the government to get the details right. Without meaningful change, consumers will continue to face fewer insurance coverage options and growing frustration.” Sign up to get the latest local news headlines delivered directly to your inbox every afternoon. Send your news tips, story ideas, pictures, and videos to news@discoverairdrie.com. You can also message and follow us on Twitter: @AIR1061FM. DiscoverAirdrie encourages you to get your news directly from your trusted source by bookmarking this page and downloading the DiscoverAirdrie app.